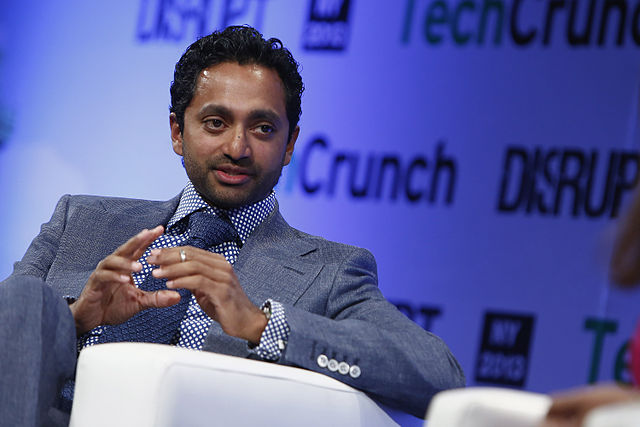

Amazon.com investor who, VC Chamath Palihapitiya, extolled the virtues of Jeff Bezos and Amazon’s potential to generate $3 trillion in profits at the Next Wave Sohn Conference in New York this week. Born in Sri Lanka, Palihapitiya became a Facebook executive after joining the tech giant in 2005. A familiar player in venture capital, he founded his own VC company Social + Capital (now called Social Capital) in 2011.

The high-level and well-known funding wunderkind venture capitalist had all eyes on him as he predicted the coming of a monopoly in IT — Amazon.com — a company which will clear any competitor from the space with its potential for not just disruption but annihilation. The investor was sure to point out the American company’s trajectory is largely in part to the management of Jeff Bezos who founded Amazon.com in 1994.

Said Palihapitiya, Bezos “[…] is building the most durable company in the world.”

According to Palihapitiya, the components of Amazon’s success will be dependent on three components:

The value of the Retail Business, which he thinks will grow to a staggering $1 trillion over the next ten years. He continues to say that retail is an “unbelievable opportunity” that Amazon will represent.

Amazon Prime started in 2005 as a paid membership service offering free two-day shipping within the United States on all Prime-specific purchases for an annual fee of $79. The popularity of the service has shown great success already but Palihapitiya believes the decade-old service is still in its infancy will show even more “phenomenal” success.

Amazon Web Service (AWS), cloud computing platform, that he calls the “blue chip of technical infrastructure”, which will continue to mature and become a ‘prime’ choice for companies who will opt to use AWS as opposed to developing their own. He continues to predict that AWS will become a $1.5 trillion venture for Amazon.

“More capability. More power. Lower costs. What [Bezos] did to retail, he will do to IT.” He continues, “We think that what [Bezos] does is harvest this cash and invest it in the business. And when you add that up, that’s $18 billion that he’s made on our behalf.”

Among the large group of investors that join him in praising Bezos’ command of Amazon are notable powerhouse VCs include Andreas Halvorsen, co-founder of the hedge fund Viking Global Investors, worth $16.7 billion as of 2012; Ken Fisher, chairman, and CEO of Fisher Investments whose net worth is approximately $2.7 billion; and Stephen Mandel, founder of the hedge fund Lone Pine Capital whose estimated worth is $2.3 billion.

With Bezos’ history in carving a significant spot for Amazon since its founding over two decades ago, Chamath Palihapitiya’s predictions may be on-point.

Source

Yahoo Finance